By Alissa Cassidy

Buying a home is one of the biggest decisions you’ll ever make, so you want to make sure you do everything right –– including the timing of it. How are the interest rates? Is there enough inventory? Do you have to sell your current home? All of these questions need to be answered before you can responsibly make the decision to buy a home.

Mortgage Rates

According to Experian, mortgage rates are expected to decrease, while inventory and home sales are likely to increase in 2024. At the end of 2023, rates were up as high as 8%, but experts predict that by the end of 2024, they’ll be hovering in the high 5% to mid-6% range.

If you’ve found your dream home and you can afford it with the current rate, remember –– you can always refinance later when the rates drop even lower.

Inventory

While much of the country is lacking for home inventory, Florida doesn’t have that problem. The Palm Coast has homes for sale in all sizes and price ranges, so finding the house you want is the easy part! When you’re narrowing down your search, be sure to think about the schools in the area if you have (or might have one day) kids. Also consider the commute to your job and proximity to shopping, the interstate, the airport, and of course, the beach!

With the high number of homes for sale right now, buying now puts you up against less competition, which can save you the struggle of a bidding war. As mortgage interest rates decrease, inventory will too, so if you find that perfect home, you could lose it if you wait too long.

Selling Your Current Home

If your home is on the market and you have to wait to sell it before you can buy another one, you can make “contingent” offers on homes you want. This means that buying the new house depends on the sale of the current home, so you won’t be stuck with two mortgages.

Another option is to get a bridge loan, which is a short-term loan that is designed to fill the gap between buying and selling your home.

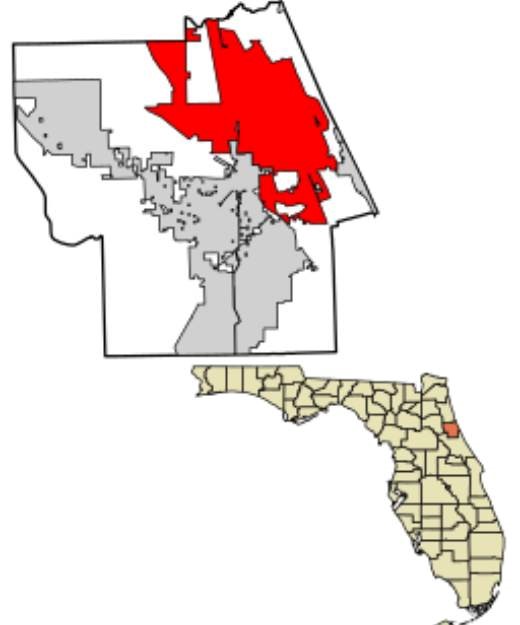

Flagler County Florida Incorporated and Unincorporated areas Palm Coast Highlighted – Source

Buying a Fixer-Upper

If you want to save some money in the long-run, you can spend less money now and buy a house that needs some TLC. These homes are certainly priced way under the typical comps, so you can get that house in the perfect neighborhood without paying too much. You’ll also end up making money if you sell later, so the benefit from making those updates and renovations is long-lasting. Plus, you can choose all the details, like paint color and flooring, and if you’re handy, you can save even more money by doing some of the work yourself.

Building a Home

If you have your heart set on buying a new construction home, we work with several builders who can design and build your dream home. This is one of the most exciting and satisfying ways to buy a home, even if it does take a little longer. You’ll get everything you need plus all the extra special touches you want, right down to landscaping ideas for small yards.

With 2024 halfway over, now is a great time to buy a home, but whether you’re a first-time home buyer or a seasoned pro, the process can be stressful and difficult. Having a professional real estate agent on your side for all the ins and outs will make it so much easier.

Alissa is a writer who grew up in Southern Florida and now lives in the Atlanta area. She’s married with three sons, is a grad student, and is an amateur photographer. When she’s not writing or studying, she enjoys working out, listening to music, and watching true crime stories.